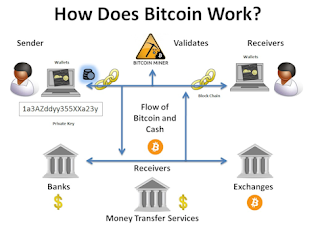

Bitcoin System Features at a glance

The money space was rocked by the news that German fintech group Wirecard filed for insolvency owing €3.5bn. Not solely a monetary failure but conjointly a seemingly “elaborate and refined fraud,” per EY, the company’s auditor for more than a decade.

Mny corporations using Wirecard’s service would have been struck by the news, and would have had to hit the panic buttons, including a few crypto companies using Wirecard for their own card payment systems.

Already a tough operation to urge right, crypto payment, and crypto payment cards are solely beginning to create their manner into the mainstream but it is instances like this that actually hinder their potential and growth. Bitcoin has had some changes in designation over the years, and as it stands, making it a payment system is tougher than it once was.

The major cryptocurrency has undergone a number of evolutions in its some eleven years of existence. The digital currency began life as a medium for exchange in transactions, and found its 1st use when ten,00zero BTC was traded for 2 pizzas (those pizza’s are now value just keep of $one hundred million).

But, simply just like the price of those 2 pizzas has changed, therefore has the designation of Bitcoin. The digital asset is today seen far a lot of like an investable asset. Bitcoin is spoken about in the same breath as stocks and commodities and is permeating the conversations of Paul Tudor Jones and also the execs at CME, Fidelity and other corners of Wall Street.

However, this fluid flow of Bitcoin System ’s designation may somewhat be seeing a shift back towards acting like “A Peer-to-Peer Electronic Money System,” as it is labelled in its own whitepaper. Recent news from Visa, PayPal and Venmo have several looking towards Bitcoin (or that ought to be cryptocurrencies, blockchain and the entire token ecosystem) for its potential in payments.

PayPal is rumoured to be rolling out direct sales of cryptocurrency to its over three hundred million users, while it's posting job vacancies for blockchain consultants. Visa has additionally started working towards the cryptocurrency area with a patent for its own type of cryptocurrency, not to mention its support of the Coinbase crypto debit card as a Visa Principal Member.

If thee is indeed a move towards Bitcoin System and crypto taking a replacement role in the evolving payments system, then the clues can probably be in the applying. One of the most important applications, and also the possible bridge to the next evolution of payments, is that the oldest, new, technology — cards.

However, because the recent news surrounding Wirecard shows, this road for crypto cards is not an straightforward one. Just obtaining a foot in the ancient card scene will be tough for Crypto payment’s solutions providers — but then there are the companies that offer the payments railways to conjointly consider.

Original fintech

The little items of plastic that just about everybody carries around in their wallets are seen as thus traditional and therefore commonplace that little thought is given to their journey. However, debit and credit cards will be seen as the original fintech, and the first digitalization of cash.

This is why they're in all probability all the primary place to seem for the following iteration of digital cash — and that would be crypto. I actually have already mentioned that Visa is doing a heap of labor relating to crypto payments and tokenization, however its chief competitor Mastercard isn't letting this new wave slip by.

I spoke with Suman Hughes, Director of Communications at Mastercard about their thoughts on cryptocurrency cards and also the incorporation of crypto as a new payments system.

“We have a tendency to see potential in cryptocurrency, especially in stablecoins. We have a tendency to have observed how using an indoor stablecoin and tokenized fiat will improve settlement. We have a tendency to are driving the development of latest products, as well as viable digital currencies that are safe, stable, reliable, and compliant,” Hughes told me.

“We are operating with governments to explore Central Bank Digital Currencies (CBDCs), which brings physical money into the modern digital age. CBDCs will enable financial inclusion, increase the efficiency of payments infrastructure and scale back informal economies.”

Unsurprisingly, the interest in the potential of crypto for a significant payment’s network like Mastercard revolves around its potential for a broader application. CBDCs are certainly on the increase, and could become a customary implemented by governments, rolled out through the likes of MasterCard and into the hands of the individuals.

Hwever, there is conjointly no getting far from the first crypto space and those that are looking to utilize their decentralized coins and cryptos in an exceedingly payments method. Coinbase, Fold and different huge crypto corporations have partnered with Visa and also the likes to roll out cards, but there are oth

I spoke with the CEO of Crypto.com, Kris Marszalek, a corporation trying to pioneer the means in regards to private crypto payments cards. He explained how it is not a simple process to compete with the legacy payments networks, even if it is with a whole new technology.

“It’s ndoubtedly challenging for a crypto startup to roll out a card product that's ready for prime time,” he told me. “It desires to figure well with traditional monetary and payment networks, which means that we should partner with established players.

“That was a judgment call we tend to created from day one. We centered on compliance, security and privacy as the foundation on that the company ought to be designed. We tend to’re building a globally trusted monetary institution that’s in the method of securing licenses in all major jurisdictions.”

“But we are building for the long run. Payment is always regarding adoption, from each a merchant and user standpoint.”

Let down by the legacy

It is not solely troublesome coming into the legacy system of payment with new monetary technology like Bitcoin System , there are also the hurdles that include some of these traditional corporations. The Wirecard news has rocked the financial world and with Crypto.com reliant on this company for its card’s, they too were struck laborious.

The FCA within the UK effectively stop working Crypto.com’s card activity within the UK and Europe to attempt and stem the harm from Wirecard’s collapse, and made Crypto.com’s hand in looking for a brand new card service provider.

"The FCA effectively stop working Wirecard UK, the issuer of our cards in Europe. Our EU/UK cards will stop operating these days. All customers will receive a hundredp.c credit back to their crypto wallets inside forty eight hours. We’re moving the card program to a brand new vendor,” Marszalek tweeted following the news.

The latest on this saga for Crypto.com is that the FCA, the U.K. watchdog, has allowed Wirecard Card Solutions, a Newcastle-primarily based subsidiary of troubled German company Wirecard AG, to resume regulated activity which means that the cards from Crypto.com have been reactivated within the UK and Europe.

These kinds of events, whereas principally a one-off and rare, do represent the opposite problems that crypto faces in trying to enter the mainstream. Payment systems are sometimes taken as impenetrable and as a given, but there are hidden dangers which will twiddling my thumbs the advancement of this house.

That being said, the long run of crypto looks laid out, and on top of that, its future as a payments system is becoming additional and a lot of probable.

The long run of the area

There are certainly tangible changes within the crypto space when it involves payments, and how these payments can be enacted and rolled out. But there's additionally a protracted means to go. However, as Marszalek explains, the digital asset bridge has already been built by cards.

“By 2030, each single person on the planet can hold digital assets one way or another. Our mission is merely to accelerate the planet’s transition to cryptocurrency. Familiar kind factors, sort of a card, play a terribly necessary role in educating main street users.”

Still, Hughes explained that there are still a range of things that need to be overcome within the crypto area for payments to be normalised with these assets.

“We tend to strongly believe that for digital currencies to become trusted payment instruments for shoppers or businesses, it's essential that they provide stability, regulatory compliance and consumer protections,” she added.

I am a souvenir-winning journalist that has covered a selection of topics from finance to economics, technology, and even sport. With the emergence of Blockchain technology…

Amid Battle For Hispanic Votes—And Florida—Trump Announces $thirteen Billion Aid Arrange Fo

Amid a heated battle for Hispanic votes in Florida between President Donald Trump and Democratic presidential candidate Joe Biden, the administration announced Friday it'd grant $13 billion in aid to assist rebuild Puerto Rico, a serious reversal for Trump, who has shown literal interest in helping th

The aid package comes as Trump and Joe Biden battle over Latino voters in Florida, where Biden is leading by only 3 proportion points, according to FiveThirtyEight.

The aid money, awarded by the Federal Emergency Management Agency, can embrace an $eleven.six billion federal share.

$nine.vi billion of the federal funds is slotted for to rebuild Puerto Rico’s antiquated energy grid, and $2 billion can attend the U.S. territory’s Department of Education to repair schools and rebuild colleges.

The White House touted the grants as exceeding “the whole Public Assistance funding in any single federally-declared disaster other than Hurricanes Katrina and Sandy,” in an exceedingly press unharness.

Florida’s Republican Senator Rick Scott praised the administration's decision to send aid on Twitter, adding “I promised to be [Puerto Rico’s] voice within the US Senate and will continue to do everything I will to support our brothers and sisters on the island.”

Rep. Nydia Velazquez (D-N.Y.), originally from Puerto Rico, blasted the administration for “dragging its feet” for so long solely to pony up much needed aid forty six days before Election Day. “It is insulting to Puerto Ricans everywhere that the Administration is so blatantly playing politics with this aid,” she said in a very statement.

https://www.cryptoerapro.com/bitcoin-system/

https://twitter.com/cryptoerapro

https://www.instagram.com/cryptoerapro/

Comments

Post a Comment